There's really no question about it: the world economy

is heading for a period of great economic uncertainty,

in which instability, trade and currency conflicts

and possibilities of economic stagnation all loom

large. This reflects the absence of a global economic

leader willing and able to fulfil the roles identified

by Charles Kindleberger: discounting in crisis; countercyclical

lending to countries affected by private investors'

decisions; and providing a market for net exports

of the rest of the world, especially those countries

requiring it to repay debt. For obvious reasons, the

US cannot currently do these, and there is no evident

alternative. That is why co-ordination is so critical

right now for international capitalism, and why its

absence will definitely be felt.

Governments

of both developed and developing countries seem to

be caught between the (often self-imposed) rock of

fiscal consolidation created by the hysteria of bond

market vigilantes and the financial media, and the

hard place created by the unwillingness to give up

what is clearly an outdated growth model. As a result,

we are faced with the worst of all economic outcomes

in terms of socially fraught stagnation in the North

and ecologically destructive and fragile expansion

in the South, with workers everywhere getting even

worse off than before.

There are three major imbalances that continue to

characterise the global economy: the imbalance between

finance and the real economy; the macroeconomic imbalances

between major economies; and the ecological imbalance

created by the pattern of economic growth. While these

are obviously unsustainable, the very process of their

correction will necessarily have adverse effects on

current growth trajectories.

As it happens, the US current account deficit is already

under correction: the current account deficit in 2009

was just above half its 2008 level, and the data for

this year suggest that it will stay at around that

level. For the rest of the world, it does not really

matter whether the reduction occurs through currency

movements or trade protectionism or domestic economic

contraction: the point is that some other engine of

growth has to be found.

Curiously, the governments of the major economies

in the global system, including G20, do not seem to

have grasped this. The rather obvious point that all

countries cannot use net export growth as the route

to expansion does not seem to have been understood;

so, all governments think they can export their way

out of trouble. This will have inevitable implications

for trade and currency wars, and the likelihood of

global economic stagnation.

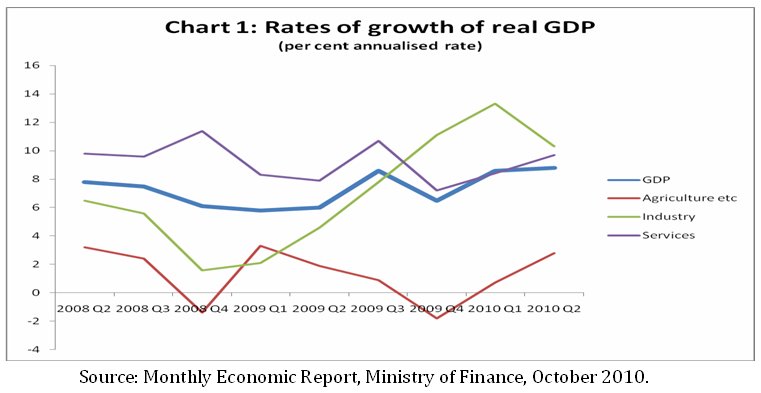

So, how well is the Indian economy likely to cope

in the near future, and how will the population as

a whole fare in these uncertain times? There has been

much celebration in the financial media in India about

how well we have weathered the Great Recession, and

certainly the output indicators (Chart 1) are impressive

in the overall global context. Despite poor agricultural

performance, rates of growth of aggregate GDP have

remained high because of continued high growth in

services and significantly accelerated growth of industry

(dominantly manufacturing).

Chart

1 >> Click

to Enlarge

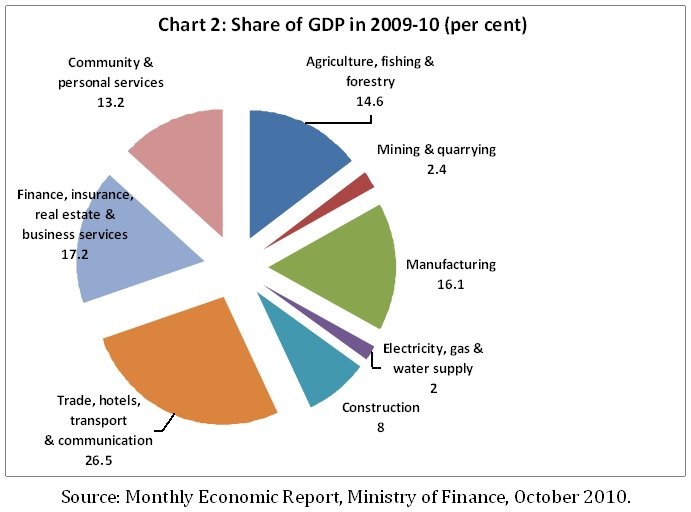

However, the recent pattern of growth has in general

been so heavily skewed towards certain services that

it has created an apparently unbalanced economy (Chart

2). Agriculture and other primary activities account

for less than 15 per cent of GDP, even though they

continue to employ well over half the workforce in

what is obviously mostly low-productivity activity.

Manufacturing has remained stable, and relatively

small in output and even smaller in employment. However,

the newer services that now dominate the GDP do not

employ too many people either, so that most other

workers are engaged in low remuneration services.

Meanwhile, the FIRE sector (finance, insurance, real

estate, and business services) has been growing rapidly

and now accounts for an even higher share of GDP than

manufacturing – a sure sign of a bubble economy.

Chart

2 >> Click

to Enlarge

So

this means that we are back to the same unsustainable

pattern of growth that generated the images of ''India

shining'': booms in retail credit sparked by financial

deregulation and enabled by capital inflows. These

have been combined, especially in the wake of the

global crisis, with fiscal concessions to spur consumption

among the richest sections of the population. This

has generated a substantial rise in profit shares

in the economy and the proliferation of financial

activities, and combined with rising asset values

to enable a continuation of the credit-financed consumption

splurge among the rich and the middle classes along

with debt-financed housing investment.

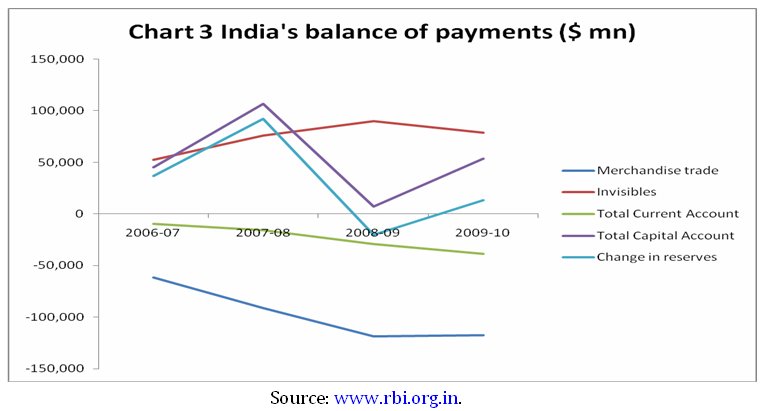

The problem is that this is associated with a balance

of payments trajectory that is fundamentally unsustainable.

As Chart 3 shows, it is only the invisibles account

(led by remittances from India workers abroad and

software and related exports) that has kept the balance

of payments from appearing to be even more stark.

The trade account shows ever growing deficits, which

are increasingly driven by non-oil imports. Meanwhile,

the large inflows of capital are really being stored

up in the form of foreign exchange reserves, for fear

of causing excessive exchange rate appreciation.

Chart

3 >> Click

to Enlarge

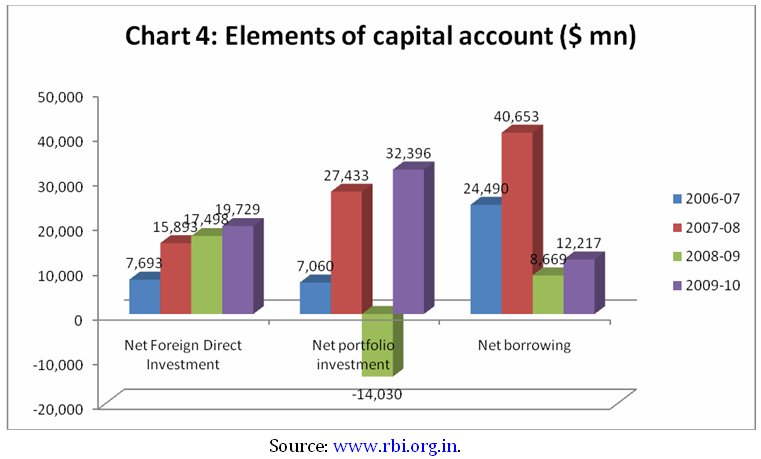

In fact, after a brief period

of reduction, India's place as a currently favoured

destination for internationally mobile capital was

reinforced in the past year. Chart 4 shows how different

elements of the captial account have behaved in recent

years. The most rapid post-crisis recovery has been

in portfolio capital, which fell during the crisis

year but surged back to high levels the subsequent

year. In fact, the most recent data (not covered in

this chart) indicates a troublesome surge in such

hot money inflows, of more than $70 billion in just

a few months – troublesome because it can lead to

an unwanted currency appreciation and because it can

just as easily flow out again.

This

is a problem plaguing several emerging economies,

and underlines the need for capital controls to prevent

unwanted inflows of speculative capital. So much so

that even the IMF has started advocating such controls

for developing countries that are being swamped by

the ''carry trade'' based on interest rate differentials

across economies.

Chart

4 >> Click

to Enlarge

Unfortunately, our own government seems much less

consious of the dangers such inflows pose, especially

for an economy that is clearly in the midst of another

bubble-driven expansion. Instead, Ministers are talking

about the economy being able to absorb at least another

$100 billion of capital inflows – unmindful of the

reality that the economy has not even absorbed the

smaller amounts that are currently pouring in, and

instead is simply accumulating reserves.

In

any case, such absorption has to be sustainable, which

is why much more attention is required to improving

the trade account. This is going to be much more difficult

in the current global economy, but clearly the need

is for both diversification of trade and more attention

to sustainable expansion of the domestic market.

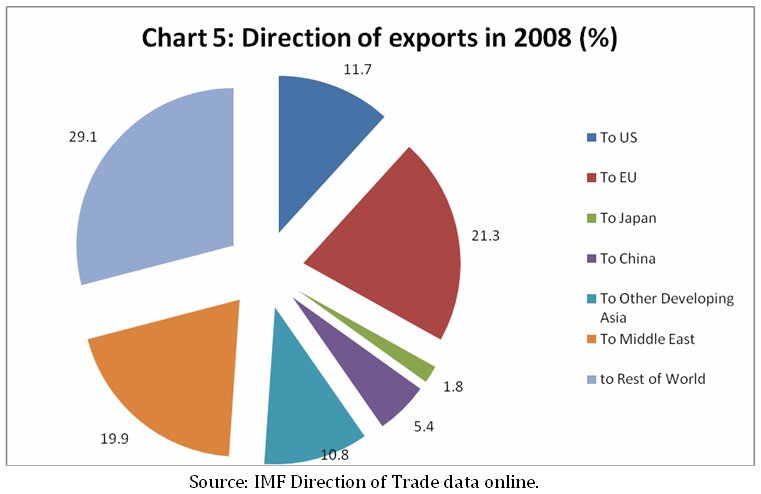

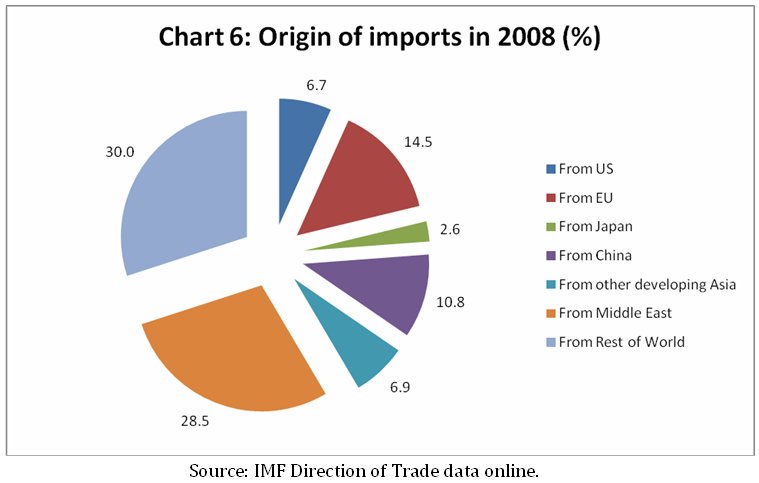

The good news is that on the external trade front

there does seem to have been a significant process

of diversification in the past decade, as Charts 5

and 6 indicate. China is among our largest trading

partners now, though that dominantly consists of India

exporting raw materials and intermediates and importing

finished goods from China. The Middle East has also

emerged as a major market, and other areas are playing

increasing roles as well.

Chart

5 >> Click

to Enlarge

Chart

6 >> Click

to Enlarge

However, without sustained expansion

of the domestic market, the condition of the bulk

of the Indian population will not improve. This really

requires increasing the disposable incomes of wage

earners and the self-employed, not just a credit-based

expansion of demand that is bound to end in tears.

But for this, there has to be more official focus

on generating both employment and better remuneration.

This is actually quite doable, since it can be led

by increased public provision of essential goods and

services (all of which are employment generating and

have high multiplier effects). But for that, we need

genuine political will.