As

an extraordinary year draws to a close, all that is

clear for the future is that very little is clear.

In the global economy, many processes that were unleashed

during this period are yet to unfold fully, and their

future direction is dependent upon several imponderables,

not least of which is the strength of the policy response

to the ongoing financial crisis and economic recession.

As this response by governments across the world is

still not co-ordinated, not even between the major

players of the capitalist system such as the US, the

European Union (particularly Germany) and Japan and

China, the immediate future remains bleak, since it

means that the market-driven forces of downswing are

likely to rule for some more time.

One feature of the recent past has been the extreme

volatility of global commodity markets, which have

experienced unprecedented price swings in the course

of the past year. Because economic analysts have become

more and more short-term and short-sighted in their

outlook, each of these rapid movements has been over-interpreted

as reflecting structural changes in global demand

and supply rather than conjunctural forces that are

themselves liable to change.

For example, when global prices in oil and other commodity

markets zoomed to stratospheric levels by the middle

of 2008, we were told that it had nothing to do with

speculation. Eminent economists joined bankers, financial

market consultants and even policy makers, in emphasising

that these price rises were all about “fundamentals”

that reflected real changes in demand and supply,

rather than the market-influencing actions of a bunch

of large players with enough financial clout and a

desire to profit from changing prices.

In oil markets, we were warned that the dire predictions

of the “peak oil” doomsayers were finally coming to

pass. In global food markets the rise in prices of

staples was correctly identified to be at least partly

related to the medium term policy neglect of agriculture

by governments especially in the developing world,

but the role of speculation in commodity futures,

enabled by financial deregulation, was denied.

Further, it was also argued that the real gainers

of this process were the direct producers: not only

oil exporting countries but small farmers producing

food grains that were becoming highly valued internationally.

The commodity price boom was supposed to translate

directly to income gains for such producers, to the

point where some governments even argued that there

was no need to provide any protection to agriculture

since cultivators were already gaining from the high

crop prices.

But the subsequent collapse of commodity prices -

both oil and non-oil - has shown how wrong the earlier

explanations were, and how little primary commodity

producers are likely to have gained, especially small

producers in the developing world. Chart 1 tracks

the behaviour of the aggregate indices of primary

commodity prices in world trade over the past two

years.

It is evident that all the price gains of the period

January2007 to mid-2008 have been wiped out by the

later fall in prices. Oil prices in November 2008

were back to the nominal level of January 2007, which

implies a decline in real terms. And non-oil commodities,

specifically agricultural raw materials and metals

were actually lower even in nominal terms. It is worth

noting that the latter group did not experience much

of a price rise even when the commodity price boom

of 2007-08 was supposedly operating in full force.

Chart

1 >> Click

to Enlarge

The likelihood of agriculturalists benefitng from

such a short-lived price boom is therefore unlikely,

especially given the lags of supply response. Indeed,

it is even likely that they could face opposite effect:

farmers shifting acreage in response to price increases

could find that prices have crashed by the end of

the growing season.

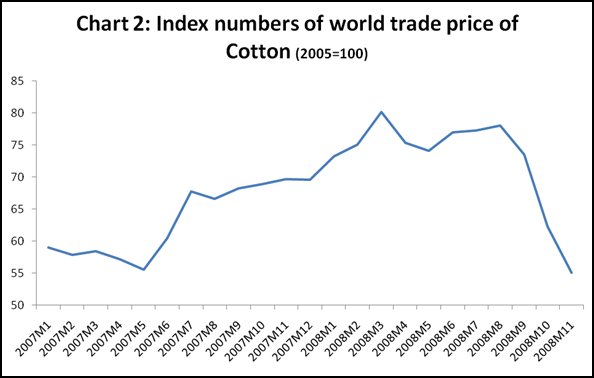

Consider, for example, the case of cotton, the most

widely planted non-food cash crop that directly affects

the livelihood of millions of farmers. Chart 2 shows

the behaviour of cotton prices, providing an index

of the Liverpool c.i.f price of middling staple cotton.

This price had fallen significantly in the past few

years, so that in January 2007 it was less than 60

per cent of the level reached in 2005. The price started

to increase around the middle of 2007, and by March

2008 had increased by 44 per cent compared to May

2007. But after that peak there has been quite a sharp

crash in prices in just a few months, such that in

November 2008 the price was actually lower than it

had been in January 2007!

Such volatility can be only very partially expalined

by real changes in demand and supply, It is true that

there was an increase in demand from China, the world's

foremost garment exporter, around the middle of 2007.

But the rapid price thereafter was beacuase speculators

took over. Similarly, while the ongoing global recession

has affected demand for clothing and therefore for

cotton, the collapse in prices cannot be explained

only by this decline, but is also the result of speculators

offloading their stocks.

The point is that cultivators who had responded to

the price signals of the short-lived boom to sow more

cotton will now find themselves stuck with a crop

whose price has nearly halved in just eight months.

Chart

2 >> Click

to Enlarge

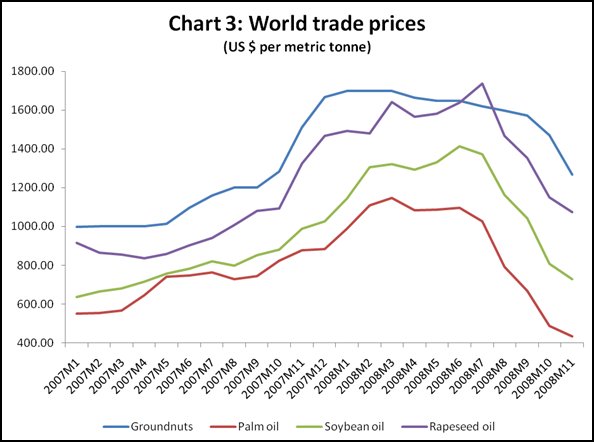

The other major cash crops that dominate cutlivation

are all oilseeds, and here too, very volatile and

sharp swings in prices are evident over the recent

period. Chart 3 describes the behaviour of world trade

prices of groundnuts which are used to make peanut

oil, as well as the other major cooking oils: palm

oil, soybean oil and rapeseed oil. All of them show

similar trends in prices, with continuous and substantial

increases from January 2007 onwards, followed by sharp

declines int he second half of the current year.

Only groundnuts prices are still significantly higher

than they were at the start of the period, having

increased by 70 per cent over 2007 and then fallen

by 34 per cent in the current year. Soybean oil prices

more than doubled between January 2007 and March 2008,

and then fell by 45 per cent, so that in Novemeber

2008 the price was only 15 per cent higher than it

was at the start of the period. A similar tendency

was apparent for rapseed oil. The sharpest rise and

fall occurred in the palm oil price – increasing by

208 per cent to March 2008 and then declining by 62

per cent, such that the price in November 2008 was

more than 20 per cent lower than it had been in January

2007.

Once again, cultivators who opted to sow these crops

when their prices were at their peak would now have

to face a completely different environment with very

different configurations of costs and prices that

coudl easily make the cultivation process completely

unviable financially.

Chart

3 >> Click

to Enlarge

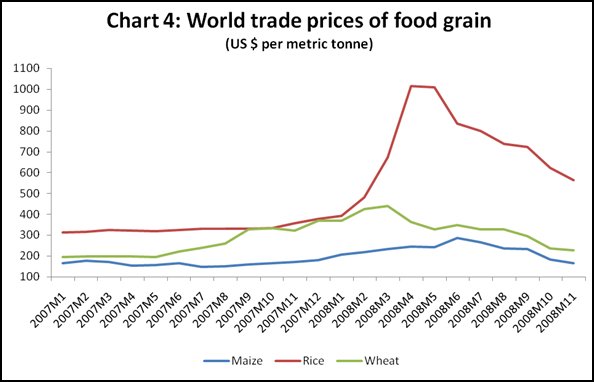

Among the agricultural prices

that matter the most, of course, are food grain prices.

The world food crisis that briefly grabbed international

headlines in the middle of the year was essentially

reflected in very darmatic increases in prices of

the most important food grains. As Chart 4 shows,

these too have been subject to significant volatility,

especially in the current year.

Chart

4 >> Click

to Enlarge

The most extreme trends have been evident in rice

prices, which were broadly stable, increasing only

gradually though most of 2007, but then exploded to

increase by more than two and a half times between

January and May 2008. Rice prices have fallen thereafter

but are still 80 per cent higher than they were at

the start of the period.

Some of this is atributable to the fact that the world

trade market for rice is relatively thin compared

to total production, as most rice producing countries

are also major consumers of their own output. The

sharp rise in prices in early 2008 can be partly attributed

to the export bans imposed by two major exporters:

India, which the previous year exported around 5 million

tonnes and Egypt which exported around 2 million tonees

out of total world exports of around 18 million tonnes.

Once again, however, speculative pressures are likely

to have pushed up trade prices well beyond anything

that could be explained by demand-supply imbalances.

Wheat prices also more than doubled between January

2007 and March 2008, and declined subsequently although

they are still 16 per cent higher than they were at

the start of the period. Maize prices went up less

sharply but continued to increase until June this

year, but thereafter fell so sharply that the maize

price is now below what it was in January 2007.

While world trade prices of these food grains did

fluctuate dramatically, and have now fallen in ways

that will adversely affect exporters of these crops,

retail prices of these grains have not come down in

most developing country markets. Therefore we have

a strange situation in which both the direct producers

and the final consumers appear to be worse off because

of the volatility.

In another context it could be concluded that speculators

have gained from this boom-and-bust price cycle, but

given the chaos in global financial markets even such

a conclusion may not be warranted. A weird example,

then, of a negative sum game in global capitalism.