| |

|

|

|

|

Factor

Shares in the Indian Economy* |

| |

| Apr

17th 2012, C.P. Chandrasekhar and Jayati Ghosh |

|

Discussions

of income distribution in the Indian economy tend to

be almost entirely based on data relating to consumption

distribution, which is typically used as a proxy for

income distribution. This is largely because the only

large and reasonably periodic (though still not annual)

datasets available are the NSSO Surveys of household

consumption, which are also useful because they allow

disaggregation of households along various other criteria

such as location, household characteristics, employment

status and so on. Even so, the exclusive reliance on

household consumption data is necessarily a limitation.

For several reasons, this approach tends to understate

the extent of inequality. Firstly, it is well known

that the nature of the surveys is such that they tend

to underestimate the tails of the distribution, excluding

the very rich and the very poor. Secondly, and possibly

more importantly, consumption covers only a part (albeit

a large part) of income, and it is also well known that

the poor are more likely to consume as much or even

more than their income while the rich are more able

to save. So income distribution is more unequal than

consumption distribution. Indeed, focusing only on consumption

distribution not only understates the extent of inequality

but also may not help in capturing changing trends,

particularly if these changes are reflected more in

savings than in consumption.

There is another way of looking at distribution, which

reflects the position of agents in the economy and identifies

them as employers, workers, those receiving “mixed incomes”

typically because of self-employment, and those receiving

incomes from financial investments. This is in many

ways the more economically illuminating way of looking

at distribution in an economy.

The classical economists Smith, Ricardo and Marx all

recognised that the most significant issues with respect

to distribution related to the distribution of power

and income among the classes, defined by their ownership

of or relation to the means of production. This in turn

affects many macroeconomic variables: the rates of saving

and investment, patterns of accumulation, the nature

of the growth process, and so on. In the Indian case,

examining the behaviour of factor shares provides important

insights into both the underlying forces of the current

growth process and the implications of aggregate income

growth for the conditions of workers and self-employed

persons.

An earlier study by Sandesara and Bishnoi (“Factor Income

Shares by Sectors in Indian Economy, 1960-61-1981-82:

A Statistical Analysis”, Economic and Political Weekly,

9 August 1986) found that in the decades of the 1960s

and 1970s, there had been a significant increase in

the share of compensation of employees, from 35 per

cent of total income to 41 per cent. They also found

declines in the mixed income of the self-employed. They

associated both of these tendencies with the structural

changes associated with growth and development, and

saw them as fairly typically processes of the gradual

transformation and diversification of the Indian economy.

However,

an analysis of the data for the subsequent period after

1980 throws up very different results. It is worth noting

that this period after which the Indian economy is generally

seen to have “taken off” in terms of transcending the

“Hindu rate of growth” to move to a higher growth trajectory,

has been one in which these tendencies have been less

marked or even reversed.

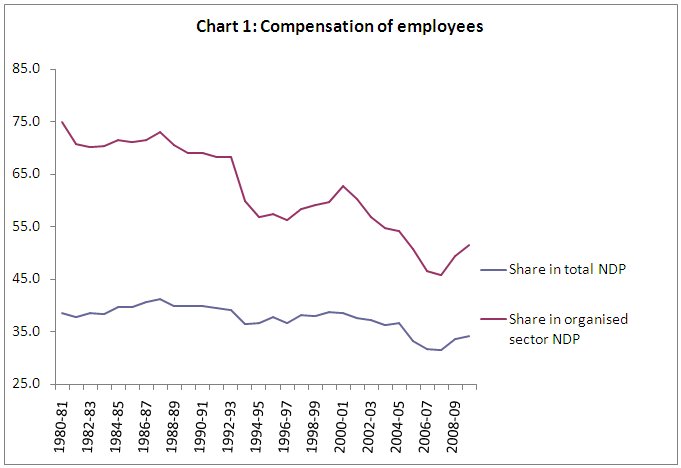

The following charts show data calculated from the CSO's

statistics on factor incomes for the period 1980-81

to 2009-10. All the data refer to current price variables.

Chart 1 shows that in terms of overall NDP, there has

been a slight and slightly uneven decline in the share

of compensation of employees, more marked especially

in the most recent years. However, within organised

sector NDP, the decline is much sharper and even quite

striking, with the share falling from 75 per cent in

1980-81 to 69 per cent in 1990-91 to 60 per cent at

the turn of the century to as low as 46 per cent in

the late 2000s, recovering slightly to 51 per cent in

the most recent year, 2009-10.

Chart

1 >>

(Click to Enlarge)

Until

2000, the CS0 provided data separately for operating

surpluses and mixed incomes (typically received by

the self-employed). However, for the past decade this

distinction has no longer been maintained and therefore

it is no longer possible to estimate how the two have

moved individually for the period after 2000-01.

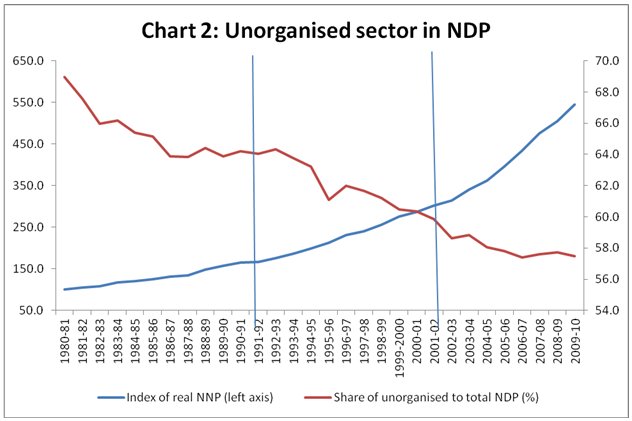

However, another important process in the past three

decades is easy to identify: the decline in the share

of the unorganised sector in GDP. This is part of

a longer term trend also identified by Sandesara and

Rao for the the previous two decades. They noted that

the unorganised sector's share of GDP declined from

74 per cent in 1960-61 to 66 per cent in 1980-81.

As evident from Chart 2, the decline in share continued

in the subsequent decades, though somewhat moderated

in the first part of the period, and experienced a

much sharper fall in the later period.

It is possible to link this with the growth of national

income, as the period of most rapid acceleration of

NNP was also the period of sharpest fall in the share

of unorganised incomes. This is obviously a process

to be welcomed as it is evidence of desired structural

change. The concern is however, that it has been accomapnied

by no increase (and even a slight decrease according

to the NSSO data) of the organised sector's share

in total employment. Thus, unorganised employment

accounts for the overwhelmingly dominant share (more

than 95 per cent) of all workers, even through the

recent period of rapid growth when its the share of

national income has been falling sharply.

Chart

2 >>

(Click to Enlarge)

From Chart 2 it is also possible to conceive of dividing

this thirty year period into three distinct phases.

The first break is clearly 1991-92, which marked the

start of the phase of liberalisation, the market-oriented

reform process in the Indian economy. This did not

mark a major acceleration of the growth of national

income, which remained at approximately the same rate

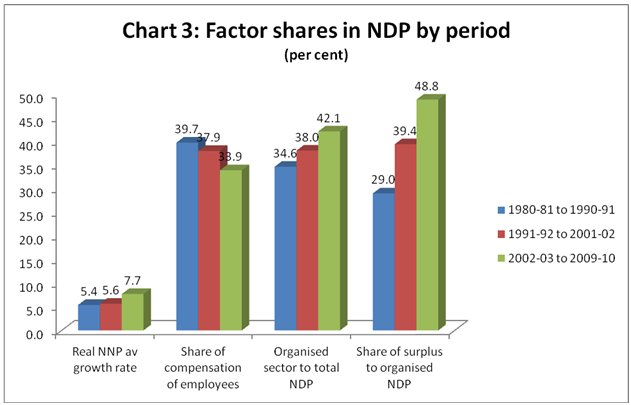

for the next decade (as evident also from Chart 3).

The second break is 2001-02, not because of any major

policy regime change, but because this was indeed

a different period in terms of growth aceleration.

Chart 3 confirms that compared to around 5.5 per cent

average annual growth of national product in the first

two period, the third period showed a jump to an average

annual rate of 7.7 per cent. The subsequent bars in

the chart indicate avaerages of share of NDP in each

of the three periods.

Chart

3 >>

(Click to Enlarge)

What emerges is that the period of growth acceleration

was also the period of significant decline in the

share of compensation of employees in aggregate NDP,

from an average of 38 per cent in the previous period

to less than 34 per cent. Meanwhile, the share of

the organised sector continued to show substantial

increases. But what is most notable is the very significant

increase within the organised sector's NDP, of the

share of surplus. It now accounts for nearly half

of the income accuring to that sector, a massive increase

over three decades.

Clearly, in the period of rapid growth, that growth

has been focussed on the organised sector in GDP terms

(though unfortunately not in employment) and the greater

part of the growth has accrued to the surplus-takers.

This confirms the reality that is increasingly apparent

within Indian society, of a growth process that has

generated significant economic inequality and concentrated

the gains among those who do not have to work as employees

in the organised sector or as self-employed workers

in the unorganised sector.

*This

article was originally published in the Business Line

on 2nd April, 2012

|

| |

|

Print

this Page |

|

|

|

|