Bilateral

investment treaties (BITs) are among the better kept

secrets of the internal economic regime in the recent

past. Increasingly, other international agreements

signed by governments are subject to much discussion

and public debate both at the negotiation stage and

during implementation. In India, for example, we are

now much more concerned about the positions taken

by government negotiators at the WTO, and there is

active debate about the various clauses in the agreements.

Yet

BITs, which have been expanding dramatically both

in number and in coverage and protection provided

to investors, remain largely outside the domain of

public discussion. The Indian government has signed

more than fifty such treaties, yet these are hardly

known, and the precise contents of such treaties are

not disseminated or discussed at all, even though

they can have all sorts of implications and also carry

a number of dangers which are only now becoming obvious

in several countries.

BITs are agreements between two countries for the

reciprocal encouragement, promotion and protection

of investments in each other's territories by companies

based in either country. In addition to providing

for basic rights of admission and establishment, such

treaties typically cover issues which are various

forms of protection to foreign investors, such as

compensation in the event of expropriation, war and

civil unrest or other damage to the investment and

guarantees of free transfers of funds and the recuperation

of capital gains.

In addition, there are usually specified dispute settlement

mechanisms, both for state vs. state and investor

vs. state. In fact, the experience so far is mainly

with investor-state disputes, since multinational

companies have been more than willing to use the provisions

of such treaties to extract concessions or compensation

for public actions.

Thus, the main provisions of such treaties tend to

be broadly similar to those in the abandoned OECD

Multilateral Agreement on Investment (MAI), and sometimes

they are even more stringent. This is of special significance

given the previous failure to impose investment rules

in the WTO, and the persistence of hopes for the renewal

of this issue. There is no doubt that once a substantial

number of countries have signed or accepted even more

sweeping provisions with respect to investment in

bilateral or regional deals, they will find it much

harder to resist MAI-type agreements at the WTO, and

may even prefer a situation in which they are all

in the same adverse situation together, rather than

being individually ''picked out''.

Earlier, NAFTA was widely believed to be the most

stringent application of such investment rules. Chapter

11, NAFTA's powerful investment chapter, provides

foreign corporations with rights to sue governments

for enacting public policies or laws which they claim

to affect their profitability. There is no provision

for exception even for such goals as safeguarding

the environment, protecting the health and safety

of citizens, supporting small businesses or maintaining

and increasing employment.

Under the investor rights guaranteed in the agreement,

investors are allowed to demand compensation for ''indirect

expropriation''. This has been interpreted to include

any government act, including those directed at public

health and the environment, which can diminish the

value of a foreign investment. These cases are adjudicated

by special tribunals, bypassing the legal system of

all three member countries. Already, suits with claims

amounting to more than $13 billion have been filed

by large companies. In a typical case in 2000, the

Mexican government was ordered to pay nearly $17 million

to a California firm that was denied a permit from

a Mexican municipality to operate a hazardous waste

treatment facility in an environmentally sensitive

location.

However, while the regional agreements such as NAFTA

have received some amount of adverse publicity, the

numerous BITs that have been signed have been subject

to very little public scrutiny, even though they can

go much further. The first BIT was signed between

Germany and Pakistan in 1959, but they did not really

become important until the 1990s. Over 400 wide-ranging

bilateral treaties were signed before 1995, but thereafter

there has been an upsurge of such treaties.

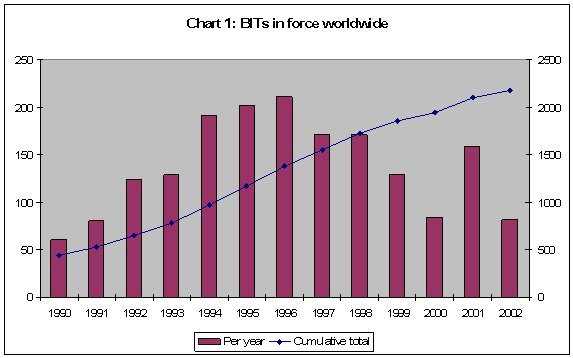

The number of BITs increased by five times in the

1990s from 385 in 1989 to 1,857 at the end of 1999.

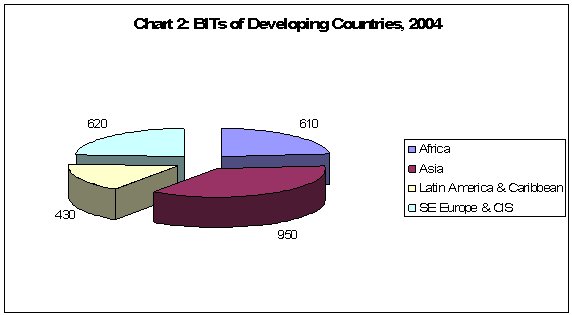

By 2004 there were estimated to be 2,365 BITs in operation.

(UNCTAD) They cover 176 countries, mostly in the developing

world and Eastern and Central Europe, and cover around

one-fourth of the stock of FDI in developing countries.

Chart

1 >> Click

to Enlarge

The

purpose of BITs is usually to provide amore stable

and secure environment for foreign investors, and

thereby to ensure ''investor confidence''. The security

and guarantees provided by a BIT are seen as essential

to encourage the inflow of supposedly much-needed

foreign investment to developing countries. Most developing

country governments are constantly told that foreign

investors need such assurances before they can be

persuaded to enter into potentially unknown or risky

markets.

However, there is little evidence that signing a BIT

actually does contribute to more FDI in developing

countries. Even the World Bank admits that ''empirical

studies have not found a strong link between the conclusion

of a BIT and subsequent investment inflows''. (World

Development Report 2005) In fact, countries without

too many BITs (such as China) have been far more successful

in attracting FDI from home countries that have signed

BITs with other developing countries.

Table

1: Number of Bilateral Investment Treaties in

2002 |

Region |

Number

of BITs

|

Countries |

Average

BITs per country |

|

|

|

|

Developed

countries |

1170

|

26 |

45 |

Developing

countries |

1745

|

150 |

12 |

Africa

|

533

|

53 |

10 |

Latin

America and the Caribbean |

413

|

40 |

10 |

Asia

and the Pacific |

1003

|

57 |

18 |

Central

and Eastern Europe |

716

|

19 |

38 |

Table

1 >> Click

to Enlarge

Chart

2 >> Click

to Enlarge

Instead, BITs have far-reaching and typically negative

implications for host country governments and citizens,

because of the sweeping protections afforded to investors

at the cost of domestic socio-economic rights and

environmental standards. A common concern about investment

agreements is that they subject countries to the risk

of litigation by corporations from or based in another

country which is a signatory to the same agreement.

This might be based on a company's objections to the

host government's environmental, health, social or

economic policies, if these are seen to interfere

with the company's ''right'' to profit.

These adverse effects are already becoming evident

in the increasing litigation which is facing developing

country governments who seek to safeguard citizens'

rights. For example, the multinational infrastructure

company Bechtel (which also deals in water supply

services) successfully currently sued the Bolivian

government under a 1992 Holland-Bolivia BIT for loss

of profits after the government's reversal of a disastrous

water privatisation in Cochabamba municipality following

a popular uprising in the area.

A number of other developing or formerly socialist

countries are facing such disputes brought by multinational

companies, ranging from Pakistan to the Czech Republic.

The most striking recent examples of the adverse effects

of BITs for the host country come from post-crisis

Argentina.

The World Investment Report 2005 describes how the

privatisation of public utilities in the early 1990s,

combined with the 54 BITs that the Argentine government

signed over the 1990s, had unforeseen adverse consequences

after the sharp devaluation of the peso during the

2002 financial crisis. The trebling of the value of

the dollar in local currency forced the government

to transform all dollar-denominated contracts into

peso-denominated contracts, including those signed

with the utility forms that were now owned and controlled

by multinational companies. In addition, the periodic

adjustment of tariffs based on foreign inflation indices

were also eliminated.

This has led to a spate of disputes instigated by

foreign investors - as many as 37 such cases have

been filed with World Bank's private arbitration body

for investment disputes, the International Centre

for Settlement of Investment Disputes (ICSID) since

2002. The first award of the ICSID tribunal, on 12

May 2005, ordered Argentina to pay $133.5 million

plus interest in compensation to the US-based multinational

CMS on grounds of violation of the BIT between Argentina

and the US. ICSID rejected the Argentine government's

plea that these were emergency measures based on the

necessity created by the dire financial, economic

and social crisis in the country.

It should be noted that the resolution of such conflicts

is not subject to the standard juridical systems of

the member countries - rather it is governed by tribunals

or similar bodies specified in the treaty. This amounts

to the privatisation of commercial justice, with no

democratic accountability of the decision makers in

this regard. In many bilateral agreements, the provisions

state that where a dispute cannot be settled amicably

and procedures for settlement have not been agreed

within a specified period, the dispute can be referred

to another body.

The two most important such bodies are the World Bank's

private arbitration body for investment disputes,

the International Centre for Settlement of Investment

Disputes (ICSID) or the UN Commission on International

Trade Law (UNCITRAL). Under NAFTA, complainants (usually

the dissatisfied investors) are allowed to choose

between these two bodies.

Domestic courts and national legal systems are completely

marginalised by investors' recourse to these international

arbitration panels. ICSID and UNCITRAL only allow

for the investor and government parties to the dispute

to have legal standing. The public has no right to

listen to proceedings or to view evidence and submissions.

Both bodies require only minimal disclosure of the

names of the parties and a brief indication of the

subject matter, which prevents public scrutiny or

popular opposition. These bodies are thus given the

responsibility to adjudicate virtually all investment

disputes without democratic structures or transparency,

despite the fact that they are not serving private

goals but an international judicial function governed

by treaty and international law.

These two arbitration bodies have developed rules

for both conciliation and arbitration that are based

completely on legal systems of the north, especially

the US, and ignore much of the world's wealth of experience

in settling disputes, such as Asian rules of arbitration.

The record of these bodies thus far has been very

investor-friendly, in awarding substantial damages

and compensation to multinational corporations for

''transgressions'' of developing country governments.

Under these conditions, there is clearly little incentive

or need for international investors to settle disputes

amicably, given the highly favourable outcomes for

corporations which have initiated proceedings under

such agreements. So BITs have become potent weapons

of multinational companies against not only governments

but also the societies of countries that have signed

these treaties.

Clearly, in this context, it is critical for civil

society across the developing world to demand that

the signing of BITs be subject to public scrutiny,

and that the proceedings disputes arising from BITs

be open and publicly accessible for the common good.