If political statements and

media headlines are adequate indicators, inflation

is emerging as India’s economic problem number one.

Given the way prices, especially of essentials in

retail markets, have been moving in recent months,

this is hardly surprising. What is surprising is that

media and political attention to a problem that has

bothered the common man for sometime now has been

rather recent.

Part of the reason for this delayed response is that

headline inflation figures offered by point-to-point

annual increases in the Wholesale Price Index (WPI)

capture trends on the ground with a substantial lag.

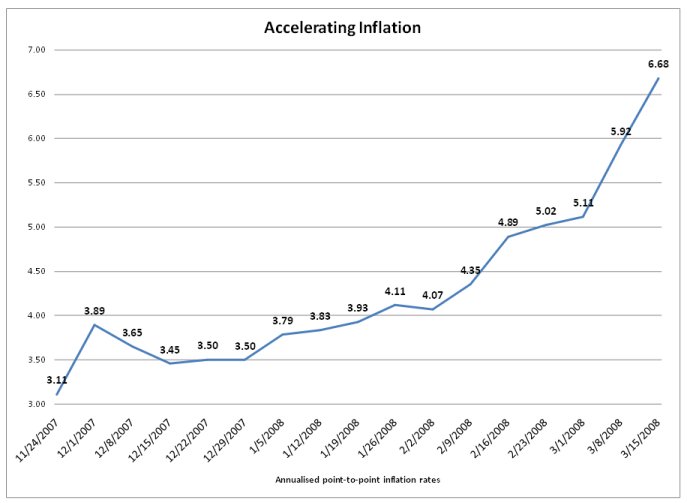

Matters came to a head when WPI-based inflation figures

relating to the week ending 15 March 2008, released

at the end of last month, indicated that the annual

rate of inflation had risen to 6.68 per cent, which

was higher than it had been for the previous 13 months.

What is more this inflation was not restricted to

a few commodities but was widely spread in terms of

its incidence. Inflation stood at 9.28 per cent in

the case of dairy products, 19.03 per cent in the

case of edible oils, 20.12 per cent in the case of

oilseeds, over 9 per cent in the case of mineral oils

and 26.86 per cent in the case of iron and steel.

The trend has continued with the annual WPI-based

inflation rate touching 7 per cent on March 22nd 2008.

The acceleration appears dramatic because going by

the WPI, even as recently as February inflation was

running low in the country, judged by historical standards

or relative to the ceiling rate of 5 per cent set

by the Reserve Bank of India. The wholesale price

index for the week ended February 2, 2008 pointed

to an annual inflation rate of just 4.07 per cent,

whereas, during the corresponding period in the previous

year annualised inflation was as high as 6.5 per cent

on a week-to-week basis. However, soon thereafter

the inflation rate started falling (even as concerns

over inflation were still being expressed), and by

October/November last year the inflation rate was

hovering around the 3 per cent level. What is being

witnessed now is a continuation of a trend that began

in December when inflation once again edged upwards

to touch 3.5 per cent in December, 4 per cent by end

January 2008, 5 per cent by late February, 6 per cent

at the end of the first week of March and then close

to 7 per cent by mid March.

It must be noted that even a 7 per cent level is by

no means high when viewed from a perspective imbued

with the tolerance for single-digit inflation levels

that characterised India in the past. But four factors

explain the almost panic-stricken response to this

rate today. First, the current level seems to be one

more step in a stairway that could quickly take inflation

to double digit levels. Second, the current level

is well above the 5 per cent mark that has been officially

declared as the acceptable ceiling rate in the wake

of fiscal and monetary reform. Third, it is accepted

that prices at the retail level are rising much faster

and inflation as measured in terms of retail prices

could be near or above double-digit levels. And, finally,

all this is occurring in a period when global inflation

is on the rise and policies of trade liberalisation

and domestic deregulation have reduced the degree

to which Indian prices are insulated from international

prices.

Of these the growing distance between retail and wholesale

prices is an important factor influencing the response.

According to figures released by the government’s

own Department of Consumer Affairs, in the last one

year, in the retail market of Delhi, the price of

groundnut oil has risen from Rs. 98 to Rs. 121 a kg,

mustard oil from Rs. 55 to Rs. 79, vanaspati from

Rs. 56 to Rs. 79, rice from Rs.15 to Rs.18, wheat

from Rs. 12 to Rs.13, atta from Rs. 13 to Rs.14, gram

from Rs. 32 to Rs. 38 and tur from Rs. 35 to Rs. 42.

In fact, figures collated by Price Monitoring Cell

of the Department of Consumer Affairs establish that

in the case of a few commodities there is huge difference

between inflation as measured by retail prices (collected

from and averaged across 18 reporting centres nationwide)

and the wholesale price index. In the case of rice,

inflation over the year ending March 15 stood at 7.88

per cent as measured by the WPI, whereas it worked

out to a huge 20.86 per cent in terms of average retail

prices. In the case of vanaspati too the inflation

rate stood at 8 and 22 per cent respectively.

These differences are bound to be reflected in the

consumer price indices for agricultural labourers

and industrial workers, which not only give greater

weight to some of the essential commodities that have

seen high rates of price inflation, but are also based

on the retail prices of these commodities. Unfortunately

the lag in the release of consumer price indices is

much greater than in the case of the WPI, the most

recent figure being for the month of February 2008.

Yet, going by the consumer price indices the annual

month-to-month rate of inflation stood at 6.38 per

in February 2008 for agricultural workers and a much

lower 4.69 per cent for industry workers. But figures

based on the March indices are likely to be much higher

given the most recent trends in prices revealed by

other sources.

A combination of domestic and international factors

is seen as responsible for this inflationary process.

A central tendency is the growing inability of the

government to use its procurement and distribution

mechanism as a means of controlling the domestic prices

of cereals and pulses. This inability stems from two

sources. The first is the failure to ensure that marketed

surpluses of these commodities grow at a fast enough

pace to match up to consumption and buffer stocking

requirements in years when demand is buoyant, as is

the case recently. The second is the liberalisation

of trade in many of these commodities that has seen

the entry of private traders including large transnational

buyers, who have cornered stocks and limited procurement

by government agencies like the Food Corporation of

India. According to estimates made by the Commission

for Agricultural Costs and Prices (CACP), the rice

stocks in the central pool as on October 1, 2008 would

be only 5.49 million tonnes, just marginally above

the buffer norm of 5.20 million tonnes. Wheat stocks

are estimated to be only 10.12 million tonnes, which

would be below the buffer norm of 11 million tonnes.

Chart

1 >> Click

to Enlarge

In the past this was not a problem because either

demand was depressed or because the government responded

to the situation by using its foreign exchange reserves

to import food and augment domestic supply. During

2006 and 2007, nearly 7.5 million tonnes of wheat

were imported by the Centre to augment buffer stocks.

However, given what has been happening to global prices,

imports have been at prices much higher than that

paid to domestic farmers, swelling the subsidy paid

to cover the difference between the import price and

the domestic sale price. Across the world, food prices,

especially those of staples like grains, have been

rising sharply in recent months. Wheat epitomises

the trend, with international prices estimated to

have risen by close to 90 per cent just during this

year.

The willingness to pay higher prices for imports even

while domestic producers are not guaranteed (with

price controls and subsidies) a remunerative return

above costs, makes it difficult to sustain the differential

between the lower domestic and higher international

prices. Stung by the criticism that the government

is paying farmers abroad more than it offers Indian

farmers, the CACP has decided to hike the minimum

support price, especially of rise. The Commission

for Agriculture Costs and Prices has recommended that

the minimum support price (MSP) for paddy be fixed

at Rs. 1,000 a quintal for the common variety and

at Rs. 1,050 a quintal for the A grade variety for

the 2008-09 kharif marketing season. This compares

with the currently prevailing MSP (including bonus)

of Rs. 745 and Rs.775 a quintal respectively. If the

recommendation is accepted, as is likely, the price

of paddy would be on par with wheat, whose support

price for the rabi season was fixed at Rs. 1,000 a

quintal as against Rs. 850 a quintal the previos year.

These changes, which reflect the desire to calibrate

domestic to international prices, are setting off

expectations of a sharp increase in the price of primary

articles. The speculation that ensues is seen as partly

triggering the current inflation in food prices.

But these developments are not necessarily driven

by a concern for India’s farmers. They are also a

consequence of the government’s decision to allow

private players, including large international firms,

a major role in domestic markets. Even though production

of wheat during 2006-07 is estimated at close to 75

million tonnes as compared with 69 million tonnes

in the previous year, procurement fell short of expectations

because the procurement price of Rs. 8.5 a kg ruled

well below market prices that ranged between Rs.10

and Rs.12 a kg. Though procurement in 2006-07 was,

at 11.1 million tonnes, higher than the 9.2 million

tonnes recorded in 2005-06, it was way below the levels

of 16.8 and 14.8 million tonnes recorded in 2003-04

and 2004-05. Figures from the Food Corporation of

India indicate that total procurement for the public

distribution system has declined from 30 per cent

of production during 2001-02 to 15 per cent in 2006-07.

This implies that with the change in market conditions

after liberalisation some degree of upward adjustment

of the floor set by procurement prices is unavoidable,

if buffer stocks are not to fall below comfort levels.

To this should be added the effects of the increase

in oil prices, of Rs. 2 a litre for petrol and Rs.

1 a litre for diesel. The government claims that this

hike is moderate and inevitable, given the sharp increase

in international oil prices. However, it is not that

there was no option. The petroleum sector contributes

more than Rs.90,000 crore by way of indirect taxes

to the Centre and Rs.60,000 crore to the States. There

is evidence of a sharp increase in direct tax collections

by the Centre. So it could have foregone a part of

its oil revenues by reducing indirect taxes and allowing

oil companies to charge more without affecting retail

prices. This is all the more important because oil

products are universal intermediates, since through

transportation and fuel costs they enter into the

costs of most other commodities. So the second- and

higher-order effects of an increase in oil prices

would be greater than in other commodities. Hence,

the government should have sought to delink domestic

oil prices from international prices through a reduction

in duties imposed on petroleum and petroleum products.

Unfortunately it has chosen not to do so.

A Gap too Wide |

(Inflation

as measured by retail and wholesale prices) |

|

Over

last 12 months |

Since beginning 2008 |

|

Retail price |

WPI |

Retail price |

WPI |

|

Rice |

20.86 |

7.88 |

3.74 |

1.95 |

|

Wheat |

4.06 |

3.97 |

3.17 |

1.39 |

|

Atta |

4.59 |

0.45 |

3.18 |

1.59 |

|

Gram |

3.95 |

3.32 |

4.41 |

3.84 |

|

Tur |

15.76 |

13.98 |

-3.55 |

1.74 |

|

Sugar |

-0.23 |

-6.87 |

5.56 |

0.59 |

|

Groundnut Oil |

14.71 |

10.11 |

2.97 |

5.86 |

|

Mustard Oil |

28.26 |

28.98 |

12.11 |

14.49 |

|

Vanaspati |

22.23 |

7.94 |

13.72 |

4.34 |

|

Potatoes |

4.12 |

29.41 |

-25.37 |

-5.41 |

|

Onions |

-27.19 |

-26.71 |

-30.63 |

-34.01 |

|

Milk |

8.07 |

9.71 |

1.90 |

1.94 |

|

Retail prices from FCAMIN Price Monitoring Cell,

averaged over 18 reporting centres |

Table

1 >> Click

to Enlarge

These are not the only areas where international factors

are influencing domestic prices trends. International,

commodities like metals have seen prices soaring because

of increased demand especially from China. Indian

firms participating in this international boom through

rising exports at soaring prices are obviously adjusting

or manipulating domestic prices upwards. This has

forced the government not only to control the rise

in prices but restrict exports. The hope that greater

integration of Indian and global markets would benefit

consumers and not producers, whereas protectionism

favours producers at the expense of consumers, has

obviously been proved wrong by circumstances.

It is in this background that the argument that in

the case of food, oil and steel domestic inflation

is being driven by international price trends has

to be judged. India was and still remains significantly

insulated from global price trends especially in the

case of commodities where exports are restricted for

various reasons. But that has been changing as a result

of the winds of liberalisation. Commodities are increasingly

being divided into those directly or indirectly catered

to by imports, and those where domestic production

caters to both domestic and global demand. In both

these cases the degree to which India has been insulated

from international trends has been reduced substantially.

That is a consequence of liberalisation and implies

that combating inflation also requires rethinking

liberalization.

Interestingly the government’s response has been exactly

the opposite. It is attempting to dampen domestic

price trends by resorting to more imports. This may

be successful in the short run in the case of commodities

like edible oils, even if at the expense of damaging

effects on the livelihoods of coconut and oilseeds

growers, for example, and adverse effects on domestic

production in these areas in the long run. But in

many other commodities import is likely to be a blunt

weapon. Unless of course it is combined with a willingness

to offer consumers of foreign products implicit subsidies

of magnitudes that are many multiples of what some

domestic consumers and producers have been offered

in the past.

Even these responses are because the current inflation

occurs in an election year and threatens to curtail

the near 9 per cent average growth rate registered

over the last five years. But there is no guarantee

of success. Fiscal year 2007-08, which has just come

to a close, appears to be an inflection point in the

current phase of post-reform growth. This is not merely

because the year saw the first significant signs of

the reversal of what was an unprecedented bull run

in stock markets. More importantly, the evidence suggests

that the government’s ability to ensure high growth

with low inflation has come to an end.