Themes > Features

12.11.2007

The Market Stabilization Scheme and the Indian Fisc

Speaking

at a full Planning Commission meeting to approve the draft of the XIth

Five Year Plan, Prime Minister Manmohan Singh expressed concern over the

mounting petroleum, food and fertilizer subsidies that are expected to

exceed Rs.1,00,000 crore this year. These subsidies he argued may be “shutting

out” development options, since such large outgoes could mean "fewer

schools, fewer hospitals, fewer scholarships, lower public investment

in agriculture and poor infrastructure". The case for reducing at

least some of these subsidies, especially those on food, is controversial

and bound to meet with opposition. On the other hand, the need to mobilize

as much resources as possible to meet expenditures of the kind the PM

refers to is unquestioned. What we need to look to are measures that would

be less controversial and more acceptable. One such would be to curb the

large and unwarranted flows of capital especially financial capital into

India in recent times, the management of which is threatening to damage

the government’s fiscal maneuverability and divert scarce resources away

from critical sectors.

That India is experiencing an unprecedented surge in capital inflows is undeniable. While the current account deficit on India’s balance of payments remained almost constant in 2005-06 and 2006-07 at $9.2 billion and $9.6 billion respectively, net capital flows into the country rose from an already high $23.4 billion to $44.9 billion. What is particularly disconcerting is that this tendency has only been intensified in recent months. Net inflows of foreign institutional investments into India’s stock and debt markets that had risen significantly starting 2003, and averaged $8.8 billion a year during 2003 to 2006, has registered a sharp jump to $18.6 billion over the first 10 months of 2007 (Chart 1).

This has also been a period when Indian corporates have been exploiting the liberalized external commercial borrowing policy and borrowing massively abroad to benefit from lower interest rates. Figures for the January to May period indicate that borrowing totaled $15.3 billion in 2007, as compared with $10.8 billion and $3.4 billion during the corresponding periods in 2006 and 2005 repectively (Chart 2).

That India is experiencing an unprecedented surge in capital inflows is undeniable. While the current account deficit on India’s balance of payments remained almost constant in 2005-06 and 2006-07 at $9.2 billion and $9.6 billion respectively, net capital flows into the country rose from an already high $23.4 billion to $44.9 billion. What is particularly disconcerting is that this tendency has only been intensified in recent months. Net inflows of foreign institutional investments into India’s stock and debt markets that had risen significantly starting 2003, and averaged $8.8 billion a year during 2003 to 2006, has registered a sharp jump to $18.6 billion over the first 10 months of 2007 (Chart 1).

This has also been a period when Indian corporates have been exploiting the liberalized external commercial borrowing policy and borrowing massively abroad to benefit from lower interest rates. Figures for the January to May period indicate that borrowing totaled $15.3 billion in 2007, as compared with $10.8 billion and $3.4 billion during the corresponding periods in 2006 and 2005 repectively (Chart 2).

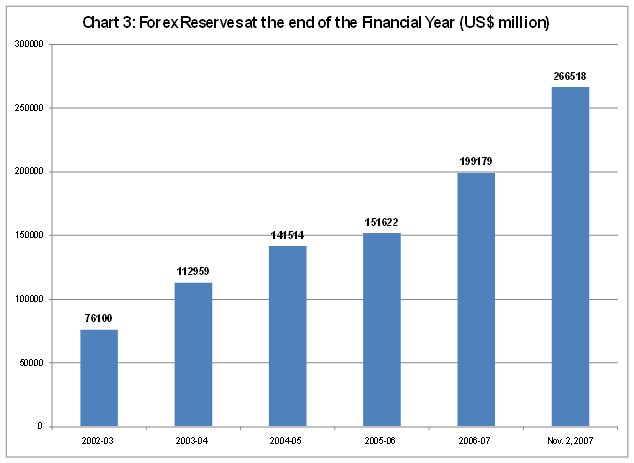

While the Reserve Bank of India has been routinely liberalizing rules governing capital account expenditures by domestic corporate and resident, this massive surge in capital inflows has put substantial pressure on the rupee. Rupee appreciation, especially vis-a-is a depreciating dollar has begun to hurt exporters of goods and services. Called upon to manage the market determined exchange rate the central bank has over the years been buying up foreign currency and expanding its reserve of foreign assets to adjust domestic demand for foreign currency to the autonomously driven inflow of foreign exchange. Forex reserves that stood at $76 billion at the end of financial year 2002-03, nearly doubled to touch $151.6 billion by March-end 2006 and have risen to $199.2 billion by end-March 2007 and $266.5 billion on 2 November, 2007 (Chart 3).

This kind of accumulation of reserves obviously makes it extremely difficult for the central bank to manage money supply and conduct monetary policy as per the principles it espouses and the objectives it sets itself. An increase in the foreign exchange assets of the central bank has as its counterpart an increase in its liabilities, which in turn implies an injection of liquidity into the system. If this “automatic” expansion of liquidity is to be controlled, the Reserve Bank of India would have to retrench some other assets it holds. The assets normally deployed for this purpose are the government securities held by the central bank which it can sell as part of its open market operations to at least partly match the increase in foreign exchange assets, reduce the level of reserve money in the system and thereby limit the expansion in liquidity.

The Reserve Bank of India has for a few years now been resorting to this method of sterilization of capital inflows. But two factors have eroded its ability to continue to do so. To start with, the volume of government securities held by any central bank is finite, and can prove inadequate if the surge in capital inflows is large and persistent. Second, an important component of neoliberal fiscal and monetary reform in India has been the imposition of restrictions on the government’s borrowing from the central bank to finance its fiscal expenditures with low cost debt. These curbs were seen as one means of curbing deficit financed public spending and as a means of preventing a profligate fiscal policy from determining the supply of money. The net result it was argued would be an increase in the independence of the central bank and an increase in its ability to follow an autonomous monetary policy. In practice, the liberalization of rules regarding foreign capital inflows and the reduced taxation of capital gains made in the stock market that have accompanied these reforms, has implied that while monetary policy is independent of fiscal policy, it is driven by the exogenously given flows of foreign capital. Further, the central bank’s independence from fiscal policy has damaged its ability to manage monetary policy in the context of a surge in capital flows. This is because, one consequence of the ban on running a monetized deficit has been that changes in the central bank’s holdings of government securities are determined only by its own open market operations, which in the wake of increased inflows of foreign capital have involved net sales rather than net purchases of government securities.

The difficulties this situation creates in terms of the ability of the central bank to simultaneously manage the exchange rate and conduct its monetary policy resulted in the launch of the Market Stabilization Scheme in April 2004. Under the scheme, the Reserve Bank of India is permitted to issue government securities to conduct sterilization operations, the timing, volume, tenure and terms of which are at its discretion. The ceiling on the maximum amount of such securities that can be outstanding at any given point in time is decided periodically through consultations between the RBI and the government.

Since the securities created are treated as deposits of the government with the central bank, it appears as a liability on the balance sheet of the central bank and reduces the volume of net credit of the RBI to the central government, which has in fact turned negative. By increasing such liabilities subject to the ceiling, the RBI can balance for increases in its foreign exchange assets to differing degrees, controlling the level of its assets and, therefore, its liabilities. The money absorbed through the sale of these securities is not available to the government to finance its expenditures but is held by the central bank in a separate account that can be used only for redemption or the buy-back of these securities as part of the RBI’s operations . As far as the central government is concerned while these securities are a capital liability, its “deposits” with the central bank are an asset, implying that the issue of these securities does not make any net difference to its capital account and does not contribute to the fiscal deficit. However, the interest payable on these securities has to be met by the central government and appears in the budget as a part of the aggregate interest burden. Thus, the greater is the degree to which the RBI has to resort to sterilization to neutralize the effects of capital inflows, the larger is the cost that the government would have to bear, by diverting a part of its resources for the purpose.

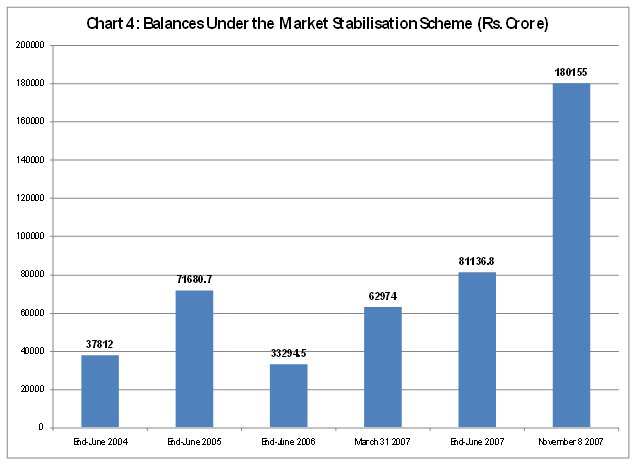

When the scheme was launched in 2004, the ceiling on the outstanding obligations under the scheme was set at Rs. 60,000 crore. Over time this ceiling has been increased to cope with rising inflows. On November 7, 2007 the ceiling for the year 2007-08 was raised to Rs.2,50,000 crore, with the proviso that the ceiling will be reviewed in future when the sum outstanding (then placed at Rs 185,100 crore) touches Rs.2,35,000 crore. This was remarkable because 3 months earlier, on August 8, 2007, the Government of India, in consultation with the Reserve Bank, had revised the ceiling for the sum outstanding under the Market Stabilisation Scheme (MSS) for the year 2007-08 to Rs.1,50,000 crore. The capital surge has obviously resulted in a sharp increase in recourse to the scheme over a short period of time.

As Chart 4 shows, while in the early history of the scheme, the volumes outstanding tended to fluctuate, since end-June 2005, the rise has been almost consistent, with a dramatic increase of Rs. 117,181 crore between March 31, 2007 and November 8, 2007. That compares with, while being additional to, the budget estimate of market borrowings of Rs. 150,948 crore during 2007-08. This increase in the interest-bearing liability of the government while not making a difference to its capital account does increase its interest burden.

There are many ways in which this burden can be estimated or projected, given the fact that actual sums outstanding under the MSS do fluctuate over the year. One is to calculate the average of weekly sums outstanding under the scheme over the year and treat that as the average level of borrowing. On that basis, and taking the interest rate of 6.7 per cent that was implicit in recent auctions of such securities, the interest burden is significant if not large. It amounts to around Rs. 5,200 crore for the year ending 2 November, 2007 and Rs. 2,500 crore for the year preceding that. But this is an underestimate, given the rapid increase in sums outstanding in recent months.

A second way of estimating the interest burden is to examine the volume of securities sold to deal with any surge and assess what it would cost the government if that surge is not reversed. Thus, if we take the Rs. 117,181 crore increase in issues between March 31 and November 2, 2007 as the minimum required to manage the recent surge, the interest cost to the government works out to about Rs. 7,850 crore. Finally, if interest that would have to be paid over a year on total sums outstanding at any point of time under the MSS scheme (or Rs. 185,100 crore on November 7, 2007) is taken as the cost of permitting large capital inflows, then the annual cost to the government is Rs. 12,400 crore.

As has been noted earlier in this column, India does not need most of the capital inflows coming into the country to finance. They are not needed to finance the relatively small current account deficit on its balance of payments. And there are reasons to believe that much of this capital inflow is speculative, is directed at the secondary market or to sectors like real estate, and makes little productive contribution to the economy. Given these features, it is surprising that the government is willing to bear a burden on its fisc to sustain these inflows rather than opt for measures to stall and reverse such flows. In the circumstances, the first effort at finding resources for the Plan should be to curb these inflows which, besides being damaging in themselves, absorb scarce resources. This is the direction in which the Prime Minister must push the Planning Commission, before raking up the controversial issues of subsidies.

©

MACROSCAN 2007