Themes > Features

03.04.2009

Balance of Payments Portents

The

rupee's recent fall, which has taken the currency's value to more than

Rs. 50 to the US dollar, is one of the more visible ways in which the

global crisis has affected India. Underlying that fall are developments

on India's external front that can be directly attributed to the crisis.

One of these is the slowdown in the country's merchandise export growth.

With merchandise trade data available till December 2008, it emerges

that India's aggregate merchandise exports have declined in each of

the three months starting October 2008. The decline in December alone

(relative to the corresponding month of the previous year) was 1.1 per

cent. As a result, over the first nine months (April-December) of this

financial year (2008-09) exports at $130.9 billion registered a 16.3

per cent rate of growth which was significantly lower than the 23.2

per cent recorded during the corresponding period of a year ago.

Merchandise imports on the other hand recorded a higher growth of 30.8

per cent during April to December 2008 as compared with the 27.6 per

cent of a year ago, because India was still affected by the burden of

higher oil prices during that period. Imports of petroleum, oil and

lubricants rose by 43.3 per cent during these months, as compared with

24.0 per cent in the previous year. In the event, the trade deficit

rose by 58.5 per cent during April-December 2008 to $93.5 billion, from

$59.0 billion during April-December 2007. There is reason to believe

that this trend has only grown stronger during the current, fourth quarter

of the financial year, giving rise to the view that the rupee's weakness

is partly due to the direct trade effects of the global recession.

While there is an element of truth in this judgement, its importance

as an explanation of the rupee's performance should not be exaggerated

for two reasons. First, oil prices have fallen further since December

and would have therefore moderated import growth. Thus, merchandise

import growth decelerated sharply from 24.3 to 8.8 per cent during the

month of December 2008 when compared with December 2007, mainly due

to a decline in oil imports. If this trend had continued the trade deficit

across the year as a whole would have widened by a smaller margin than

it did during the first nine months. Second, the evidence available

for the first six months of 2008-09 suggest that the effect of the recession

on India's services exports have been operative with a significant lag,

allowing for services incomes to neutralise part of the widening trade

deficit and moderating the increase in the current account deficit.

Thus, net services incomes on the current account of India's balance

of payments, which rose from $14 billion to $18 billion between April-September

2006 and April-September 2007, registered a further rise to $22.9 billion

during April-September 2008. Similarly, private transfers (largely remittances)

rose from $12.7 billion to $17.5 billion and $25.7 billion. As a result

of these developments, while the trade deficit during April-September

2008 was $26 billion higher than a year ago, the current account deficit

had only widened by $11.4 billion.

The lag in the effects of the crisis on net services incomes may be

due to the fact that contracts in certain areas such as software and

BPO services are signed for long periods such as two to three years.

The effect of the crisis would be on the renewal of contracts and the

signing of new contracts. Since recent years have been characterised

by persistently higher rates of increase in revenues, even if there

is a shortfall in renewals or new agreements, the impact on aggregate

revenues would initially be proportionately low because of the weight

of legacy contracts in the total. This could mean that when the data

for the year as a whole becomes available the slowdown may be greater

than suggested by the April-September figures. The lag is likely to

be even greater in the case of remittances because even if workers are

losing jobs and returning they would return with whatever accumulated

savings they have, and this windfall effect may more than make up for

the fall in the value of ongoing remittances because of lower overseas

employment.

Overall, therefore, while a widening current account deficit would have

a role in explaining the depreciation of the rupee, the sharp fall in

the currency's value must largely be due to factors reflected in the

capital account. This should not be surprising given the extremely important

role that capital flows have come to play in India's balance of payments.

Though services exports and remittance incomes have helped India keep

its current account deficit low, the large reserves it has accumulated

are the result of capital inflows that were far in excess of its current

account financing needs.

This disproportionate dependence on capital flows, which was substantially

in the form of portfolio capital, is substantially a recent development.

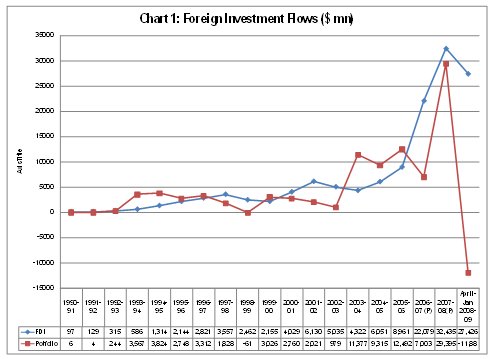

Foreign investment flows rose sharply from $4.9 billion in 1995-96 to

$29.2 billion in 2006-07 and then more than doubled to $61.8 billion

in 2007-08 (Chart 1). This increase would not have been possible without

the relaxation of sectoral ceilings on foreign shareholding and the

substantial liberalisation of rules governing investments and repatriation

of profits and capital from India. But liberalisation began rather early

in the 1990s, whereas the expansion of foreign investment flows occurred

much later. Thus, till 2002-03, the maximum level of net foreign investment

inflow reached was $8.2 billion in 2001-02. This rose to $15.7 billion

in 2003-04, partly encouraged by tax concessions offered to foreign

investors in that year. After that India was discovered by foreign investors

and was more the target of a capital investment surge rather than an

attractor of such flows.

What

is disconcerting, however, is the 111 per cent surge in capital flows

to India during the financial year 2007-08, from $29.2 billion in 2006-07

to $61.8 billion in 2007-08. This was very different from the experience

in Asian emerging markets as a group. The Institute of International

Finance estimates that net direct and portfolio equity investment into

Asian emerging markets (China, India, Indonesia, Malaysia, Philippines,

South Korea and Thailand) fell from $122.6 billion in 2006 to $112.9

billion in 2007 and an estimated $57.9 billion in 2008. This implied

that private foreign investors in equity were pulling out of emerging

Asia as a group at a time when investments in India were rising sharply.

India was serving as a hedge when uncertainties were engulfing markets

elsewhere in Asia and the world. This increased the possibility that

if any development within or outside India warranted pulling out of

that country, the exit can be as strong as the inflow of foreign capital.

The crisis has indeed resulted in a sharp outflow of capital, especially

capital brought into the stock market by foreign institutional investors.

Needing cash to meet commitments and cover losses at home, these FIIs

are selling out in Indian markets and repatriating capital abroad. Thus,

over the year ending January 2009, the Reserve Bank of India estimates

that the net outflow of FII capital amounted to $23.7 billion (Chart

1). This is indeed large when seen in relation to the estimate made

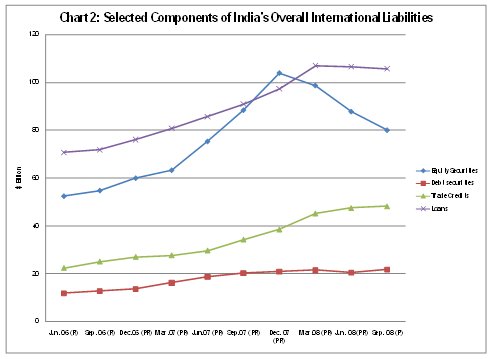

by the RBI that the total stock of inward investment in equity securities

stock stood at 103.8 billion at the end of December 2007. That stock

had fallen to $80 billion by the end of September 2008 (Chart 2).

However, even here the decline has been moderated by the persistence

of what are defined as foreign direct investment flows. Net foreign

direct investment which rose from $4.3 billion in 2003-04 to $34.4 billion

in 2007-08, remained high at $27.43 billion during April-January 2008-09.

But for this inflow, the impact of the exodus of portfolio capital on

India's reserves position would have been far more adverse. India's

foreign exchange reserves, which stood at $292.7 billion at the beginning

of February 2008 fell to $248.6 billion at the end of January 2009.

This is a significant fall, but the volume of reserves still remains

high, amounting to around 9 months worth of imports. This fall does

explain the weakness of the rupee, but still leaves the recent sharp

decline of the rupee a bit of a puzzle.

Perhaps the resolution to that puzzle lies in the other component of

capital flows into India, debt. For a few years now Indian corporations

had been engaged in a version of the carry trade, borrowing money in

foreign exchange from the international markets where interest rates

were lower and making investments in India (besides financing investments

abroad). Net external borrowing by India rose from $24.5 billion in

2006-07 to $41.9 billion in 2007-08, because of an increase in net medium

and long term borrowing from $16.1 billion to $22.6 billion and of short

term borrowing from $6.6 billion to $17.2 billion. The stock of India's

liabilities in the form of debt securities, trade credits and loans

has risen from $105.1 billion at the end of June 2006 to $175.6 billion

at the end of September2008. This huge expansion means that the demand

for foreign exchange to meet interest and amortization payment commitments

would be large in the coming months, when the exodus of foreign capital

may continue and even intensify. This could sharply reduce the Reserve

Bank's reserves as well as tighten the foreign exchange market. That

expectation may be resulting in a situation where those with commitments

due are buying up foreign exchange and speculators are holding on to

and not repatriating back to the country foreign exchange or are transferring

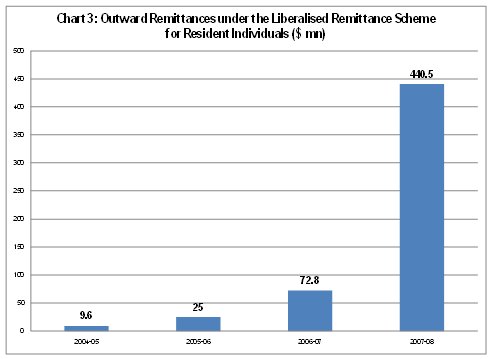

foreign exchange out of the country. One indicator of the last of these

tendencies is the movement of foreign exchange out of the country in

the form of outward remittances under the liberalised remittance scheme

for resident individuals. These remittances totalled $9.6 million, $25

million and $72.8 million in the three years ending 2006-07. But they

shot up to $440.5 million in 2007-08 (Chart 3). This is possibly indicative

of the speculative trends pushing down the value of the rupee.

If this is true it does not bode well for the balance of payments and

the rupee. In the face of speculation even a reserve in excess of $200

billion is no insurance against a crisis.

©

MACROSCAN 2009