Themes > Current Issues

08.01.2008

More Space for Speculation

C.P.

Chandrasekhar

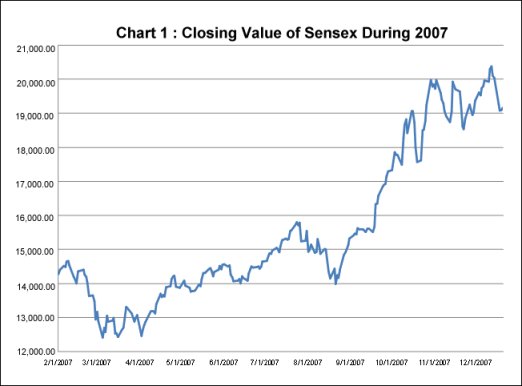

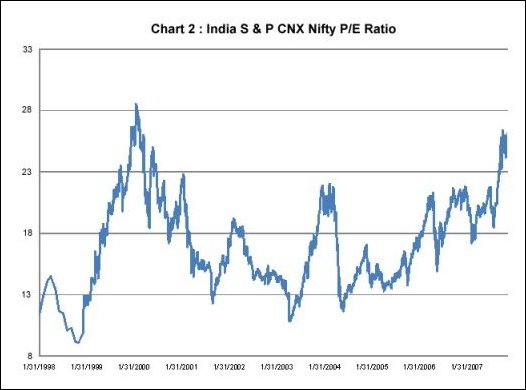

The

Sensex still hovers near the speculative peak it touched recently, having

risen from just below 14000 to more than 20000 (or by around 45 per cent)

over a four month period. Fundamentals do not seem to warrant this high

level. The S&P CNX Nifty price-earnings (P/E) Ratio is, at around

26, close to the peak of 28.5 it reached during this decade. Many observers,

therefore, feel that some correction is inevitable since excess liquidity

in the market has driven share prices to levels that are not sustainable

(see Charts).

At precisely this moment when the boom driven by past speculation threatens to unravel, the Securities and Exchange Board of India (SEBI) has decided to permit institutional investors to indulge in short selling, or the sale of shares that they do not own, and to restore the Securities Lending and Borrowing Scheme which will allow market players to borrow stocks to either sell or honour delivery commitments. A notice on the SEBI website declares: "SEBI vide its circular dated December 20, 2007, has decided to permit short selling by institutional investors. Hitherto, only retail investors were allowed to short sell. In order to provide a mechanism for borrowing of securities to enable settlement of securities sold short, it has also been decided to put in place a full-fledged securities lending and borrowing (SLB) scheme for all market participants in the Indian securities market. The Stock Exchanges and the Depositories have been advised to put necessary systems in place in this regard."

Short selling by institutional investors is not new to the Indian market. In fact it existed more than six years back and was banned in early 2001 because short-selling by a cartel of brokers resulted in a market collapse. They chose to short sell when they found out that "big bull" Ketan Parekh in search of big profits and expecting a spike in stock prices was building up a strong position in a few selected scrips in the run up to the budget. What followed was not just a collapse of the market but a full-fledged scam. There were three aspects to the 2001 scam. One related to the ability of Ketan Parekh to make huge purchases of stocks, based on the speculation that the budget would trigger an increase in stock prices. The second related to the manner in which the bear cartel detected Ketan Parekh’s ploy. And the third related to the ability of the cartel to acquire large volumes of the concerned scrips to sell short at the high prices that prevailed because of Parekh’s acquisitions, in the hope that they could drive down prices and purchase at low prices to settle their short positions.

The first two are not of immediate concern today. Suffice it to say that Parekh was issued pay-orders, which are in the nature of demand drafts, by the Ahmedabad-based Madhavpura Mercantile Cooperative Bank (MCCB), without any reciprocal pay-in of funds either directly in the form of cash or indirectly in the form of deposits that could serve as collateral for a loan. MCCB did that because it was confident it could gain in multiple ways by Parekh’s speculative activity. The acquisition of information by the bear cartel was also through inappropriate means. A sharp rise in prices provided the signal for the bear cartel to turn suspicious. The cartel allegedly consisted of stock-market insiders, including the then BSE chief himself, who in violation of SEBI norms reportedly checked out from the surveillance department who was making large purchases and of which stocks. That was how the cartel discovered that the rise in the index was the result of speculative purchases by Parekh of select shares.

At precisely this moment when the boom driven by past speculation threatens to unravel, the Securities and Exchange Board of India (SEBI) has decided to permit institutional investors to indulge in short selling, or the sale of shares that they do not own, and to restore the Securities Lending and Borrowing Scheme which will allow market players to borrow stocks to either sell or honour delivery commitments. A notice on the SEBI website declares: "SEBI vide its circular dated December 20, 2007, has decided to permit short selling by institutional investors. Hitherto, only retail investors were allowed to short sell. In order to provide a mechanism for borrowing of securities to enable settlement of securities sold short, it has also been decided to put in place a full-fledged securities lending and borrowing (SLB) scheme for all market participants in the Indian securities market. The Stock Exchanges and the Depositories have been advised to put necessary systems in place in this regard."

Short selling by institutional investors is not new to the Indian market. In fact it existed more than six years back and was banned in early 2001 because short-selling by a cartel of brokers resulted in a market collapse. They chose to short sell when they found out that "big bull" Ketan Parekh in search of big profits and expecting a spike in stock prices was building up a strong position in a few selected scrips in the run up to the budget. What followed was not just a collapse of the market but a full-fledged scam. There were three aspects to the 2001 scam. One related to the ability of Ketan Parekh to make huge purchases of stocks, based on the speculation that the budget would trigger an increase in stock prices. The second related to the manner in which the bear cartel detected Ketan Parekh’s ploy. And the third related to the ability of the cartel to acquire large volumes of the concerned scrips to sell short at the high prices that prevailed because of Parekh’s acquisitions, in the hope that they could drive down prices and purchase at low prices to settle their short positions.

The first two are not of immediate concern today. Suffice it to say that Parekh was issued pay-orders, which are in the nature of demand drafts, by the Ahmedabad-based Madhavpura Mercantile Cooperative Bank (MCCB), without any reciprocal pay-in of funds either directly in the form of cash or indirectly in the form of deposits that could serve as collateral for a loan. MCCB did that because it was confident it could gain in multiple ways by Parekh’s speculative activity. The acquisition of information by the bear cartel was also through inappropriate means. A sharp rise in prices provided the signal for the bear cartel to turn suspicious. The cartel allegedly consisted of stock-market insiders, including the then BSE chief himself, who in violation of SEBI norms reportedly checked out from the surveillance department who was making large purchases and of which stocks. That was how the cartel discovered that the rise in the index was the result of speculative purchases by Parekh of select shares.

Armed with that information the cartel decided to short sell these stocks, i.e., sell at the prevailing high prices stocks they did not own. How did they manage to do that? They used an avenue afforded by stock-market rules framed in the wake of liberalization to increase liquidity in the market: the right to borrow and lend stocks to faciliatate short selling. Under the Securities Lending Scheme introduced in 1997, holders of stocks lodged with the depository, like the Stockholding Corporation of India Ltd (SHCIL), could come to an agreement, implemented through the intermediary, to lend these stocks to others for a specified period of time for an interest. Some stocks holders like the FIIs and institutions like the UTI and the insurance companies often have large volumes of individual stocks in their kitty. So long as members of the bear cartel have information as to which players have large volumes of specific stocks, they can work out a deal to borrow these shares, providing them access.

Knowledge of the existence and source of the required shares can encourage the practice of short-selling, or sale of shares not owned by the trader, in the belief that prices are going down and the shares can be made good to the actual owner by buying them back at much lower prices at a later date. That this practice was resorted to by the bear cartel is clear from the fact that the SEBI decided to ban short-sales in the wake of the collapse in stock indices in March 2001. Thus the bear cartel clearly required little by way of own resources to indulge in the activities that led up to the collapse of markets.

The right to short sell and the facility of borrowing shares to indulge in short selling it emerged was prone to misuse in a stock markets of the kind that existed then and continue to exist in India. These markets are thin or shallow in at least three senses. First, only stocks of a few companies are actively traded in the market. Second, of these stocks there is only a small proportion that is routinely available for trading, with the rest being held by promoters, the financial institutions and others interested in corporate control or influence. And, third the number of players trading these stocks are also few in number. This allows speculators with access to liquidity to influence prices and swing markets. Even before the Ketan Parekh scam, the SEBI’s Committee on Market Making had noted the following: "The number of shares listed on the BSE since 1994 has remained almost around 5800 taking into account delisting and new listing. While the number of listed shares remained constant, the aggregate trading volume on the exchange increased significantly. For example, the average daily turnover, which was around Rs.500 crore in January 1994 increased to Rs.1000 crores in August 1998. But, despite this increase in turnover, there has not been a commensurate increase in the number of actively traded shares. On the contrary, the number of shares not traded even once in a month on the BSE has increased from 2199 shares in January 1997 to 4311 shares in July 1998." The net impact is that speculation and volatility are essential features of such markets.

If factors such as these and the scam experience encouraged the regulator at that point in time to ban short selling by institutional investors and the practice of borrowing and lending stocks, why has it decided that it is appropriate to reintroduce these practices at this point in time, when stocks are clearly overvalued. The argument in favour of such practices is that they increase liquidity in the market and correct stock price over-valuation. The fact of the matter, however, is that at the present moment it is excess liquidity in the market driven by FII investments that has been responsible for the stock price overvaluation noted earlier. Thus during the first 10 months of 2007 (till November 8) inflows of foreign institutional investor (FII) capital into the stock market in India totaled $18.6, as compared with just $3.2 billion during financial year 2006-07 and $9.9 billion during financial year 2005-06. In the circumstances the requirement is not one of increasing liquidity in the market but moderating liquidity so as to prevent a shallow market from registering equity price increases of a kind that in a matter of a few months catapult some of India’s capitalists to the top of the global league of wealthy individuals. This requires discouraging inflows of financial capital rather than injection of liquidity that can keep the speculative spiral going.

If that does happen, short selling facilitated by the borrowing and lending of shares can encourage activities of the kind that resulted in the collapse of the market in 2001. What needs to be noted is that both in terms of the price earnings ratio and the nature of the surge in markets the current situation is either similar to or even more dodgy than that which prevailed in early 2001. Of course, it could be argued that the FIIs responsible for the recent surge are not pigmies of the kind that Ketan Parekh was, reliant on illegally acquired capital for their investments. But because these entities are cash rich and include highly leveraged, speculation-prone institutions like hedge funds and private equity firms looking for abnormal returns, some among them might choose to use the short selling option when markets are high in the hope that the market can be maneuvered downwards to ensure large profits. If a 2001-type collapse is feared, FIIs with a large cumulative stock of investments can choose to book profits or cut losses and exit, resulting in a market collapse and a full-fledged financial crisis.

SEBI has, of course, advised all stock exchanges to "ensure that all appropriate trading and settlement practices as well as surveillance and risk containment measures, etc. are made applicable and implemented in this regard." It has included in its guidelines the requirement that institutional investors should disclose at the time of placing the order whether the transaction is a short sale or not and that retail investors must make a similar disclosure at the end of the trading day, so that the information can be made public in order to prevent surreptitious speculation. It has also specifically disallowed "naked short selling" (or short sales that are not settled with delivery of shares) and mandated that settlements under the short selling and securities lending and borrowing (SLB) schemes shall be on a gross basis at the client level, with no netting of transactions.

While these elements of caution are welcome, their objective is unclear. The short selling and SLB schemes are clearly meant to provide some space speculation so as to increase liquidity. To then mandate that such speculation should be transparent and orderly is self-contradictory. Since markets are doing "well" and liquidity is as yet not a problem an appropriate cautionary stance would be one which does not create more space for speculation in an already overheated market.

© MACROSCAN

2008